Practice Leader with a hands-on style with hands-on style and proven track record of winning high-dollar contracts with Fortune 500+ clients.

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Strategic & Process Consulting / Professional Services / Business Services / IT Services / B2B

Executive Profile

Highly accomplished business executive and industry recognized practice leader with proven track record of building strong sustainable, world-class, professional organizations, expanding market share, growing 'high-profile' customer base, and driving ROI for both company and clients.

Enjoys a reputation for being intensive, rigorous, demanding, a persuasive negotiator, proactive engagement manager who provides visionary, strategic & thought leadership in business and product development, sales and marketing, and a full range of client services.

'Rainmaker' with unique selling/closing skills and leadership ability to build winning selling teams designed to close major contracts with Fortune 500 and high-end, mid-market clients.

'Hands-on' engagement leader who has the expertise and deep industry knowledge to also build and lead service delivery teams on projects and engagements to ensure client satisfaction and retention.

Portfolio Highlights

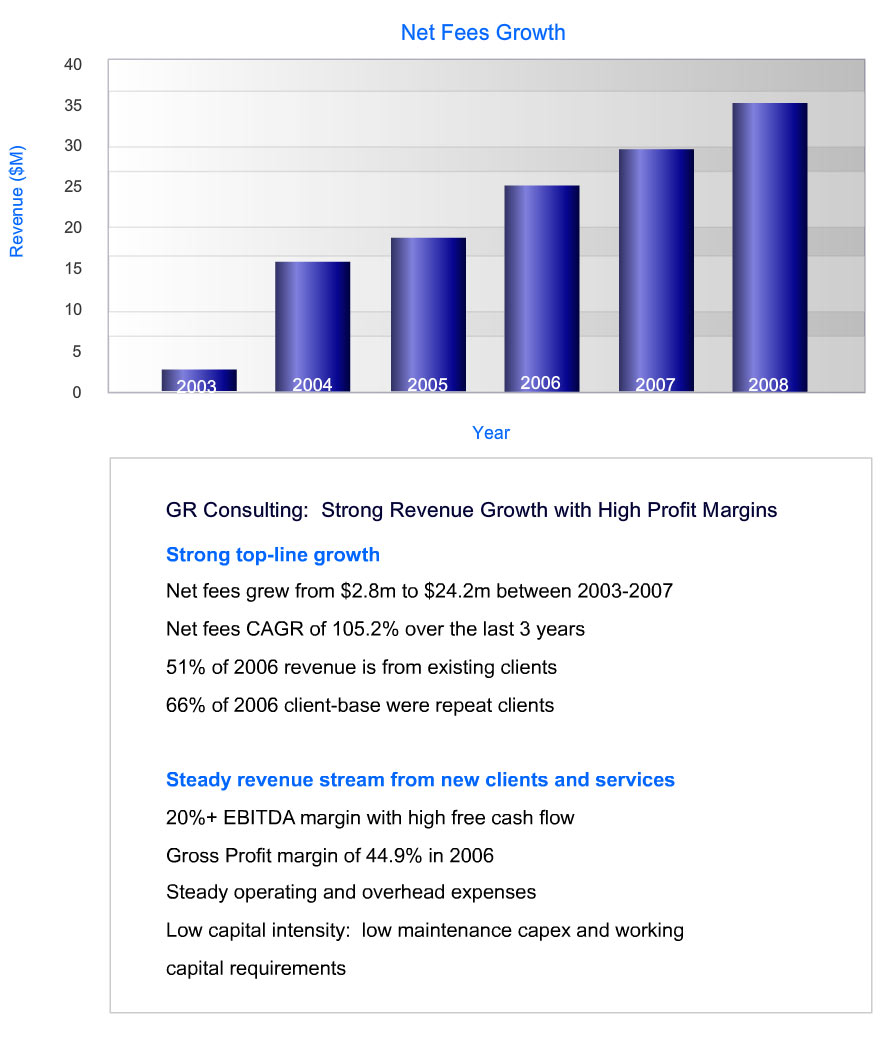

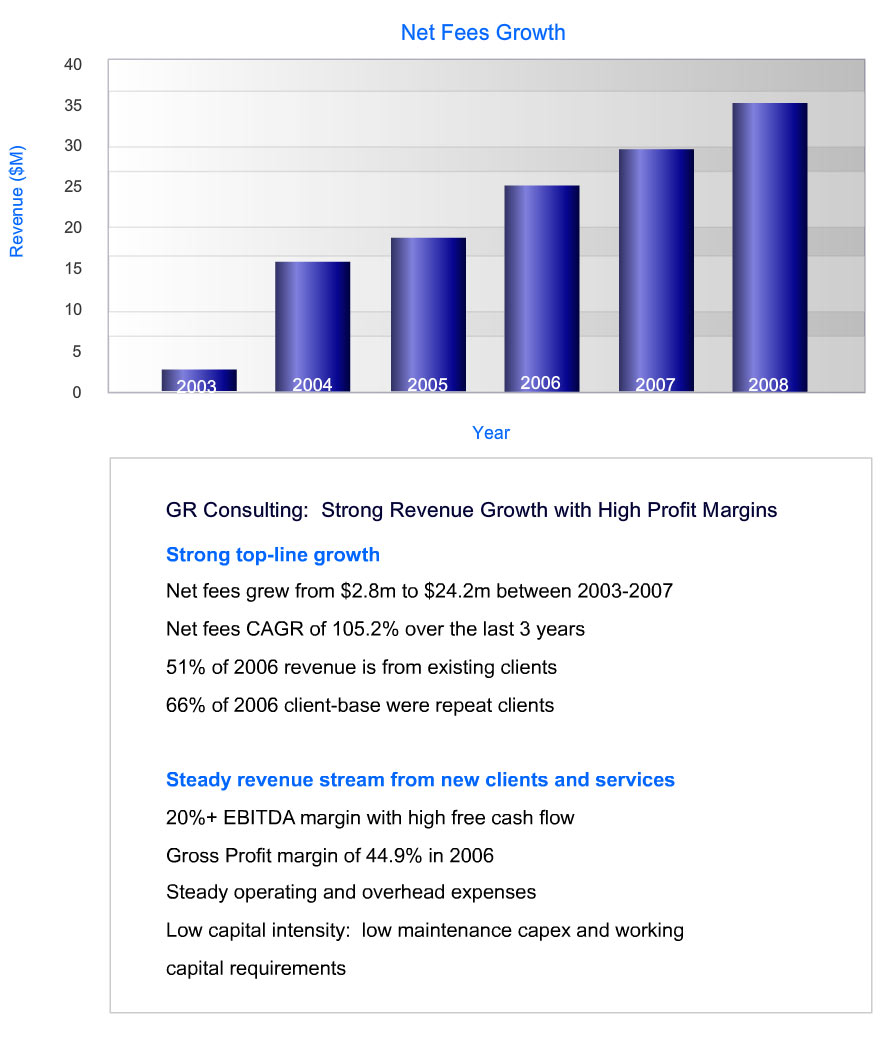

- Launched, led and built a thriving $28+ Million, B2B consulting and management advisory services startup.

- Built an organization that earned distinction as the 'fastest growing consulting firm as rated in 2006 by Bowman's Top 100 with National and International Clientele.

- Achieved a $2.5 million to $23 million dollar growth in net fees in 5-year 2002-06 timeframe.

- Expanded international service delivery capability to 45 countries worldwide.

- Achieved the highest personal engagement sale of $9.5 million to ICI Global, realizing $8 million in savings the first year and $7.5 million thereafter.

- Maintained a high-performing organization with 10 direct reports and +250 professionals that has sustained over 90% utilization with little or no non-billable time, with access to more than 6,000 professional resources leveraged throughout Europe and Asia.

- Received the 'Vision Award' as top-performing Director nationally selling 200% over goals.

Print this Page

Print this Page

Increased sales volume from $2.5 million to $23 million within 5 years by developing/executing channel marketing strategy.

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Enterprise Level

- Strategic Planning & Integration

- Global Operations

- World-Class Services Delivery

- P&L (revenue growth)

- Start Ups / Turnarounds

- C-Level Presentations

- High Dollar Negotiations

- Business Expansion

- “High-Profile” Clients

- New Products/New Markets

- Sales Forces Development

- Leader of Cross Functional Teams

- Engagement Management

- Change Management

- Consultative Sales

- CFO and Senior Financial Management

- Forecasting, planning and budgeting procedures

- External relations with banking executives, investment bankers, lawyers and accountants

- Brokerage leasing management, tax structure evaluation

- Venture capital expertise in planning and execution of investments and sales

Services Delivery-Client Engagement Level

- Corporate governance, enterprise risk management

- Compliance, SEC reporting

- Business process redesign, transformation and outsourcing

- Accounting and audit support, fraud prevention and detection

- IT audit, IT security and Cybersecurity

- ERP controls optimization, application selection & implementation, shared services design & implementation

- IT/IS Based Solutions

- IT Managed Services

- Strategic advisory services, organizational assessment, operational review

- Acquisition & divestiture analysis, pre- and post-merger integration

- Internal audit co-sourcing and business process reengineering

- Outsource accounting and financial management registrant and emerging markets

- Audit and litigation support, expert witness testimony

- Interim CFO, financial transformation, financial operations and financial planning, budgeting and forecasting

Print this Page

Print this Page

Generated $100M in working capital by driving the turnaround of operations to effectively meet adverse industry conditions.

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Selected Achievements

Business Development & Strategic Planning

- Started a new consulting and advisory services in Integrate Consulting focused on development and delivery of Business Enterprise Architecture platform and to facilitate business transformation, GRC/ERM , technology ERP implementation and performance reporting and monitoring for Fortune 1000 organizations across industry sectors.

- Developed/grew start-up B2B services firm of $28 million to fastest growing of "Bowmans Top 100" in 2006. (GRC, LLC)

- Sold a consulting business to an international "Big 5" firm at a substantial multiple.(GRC, LLC)

- Built a fully integrated $10 million consulting and advisory practice for CBIZ in just three years providing service to Fortune 500 and Mid-Market companies in the manufacturing, chemical, healthcare, financial services, real estate and not-for-profit industries.

- Increased firm profitability 20%-30% per year by expanding operations into new markets and products.(Integrate,GRC,CBIZ,E&Y)

- Increased product lines and service margins by 40%, average DSO's were 30 days, and ran 50% below industry average regarding recruiting/sourcing costs.(Integrate,GRC,CBIZ)

- Expanded the outsourcing and consulting practice of an $85 million national business advisory firm CBIZ and its tax & attest practice by over $8 million in just 20 months through strategic acquisitions, yielding a 20% increase in total revenue within two years.

- Negotiated with lenders to allow for the restructure, extension and acquisition of a $2.5B debt portfolio which provided company with an additional $100M in working capital in challenging times to sustain operations as well as expand development capability by 30% in new markets.(PRA)

Operations Improvement

- Expanded operations to encompass international delivery capability to 45 countries.(GRC, LLC)

- Stabilized operations sales mix to include 51% of total firm sales generated from recurring clients 51% of total client revenue obtained from expansion of existing services and recurring audit and advisory engagements (GRC, CBIZ)

- Maintained a 90% plus utilization rate with little or no non-billable time status for over 250 professionals.(GRC, LLC)

- Orchestrated the entire MIS conversion of all financial and operational applications within a multi-company and partnership environment for a $2.5 billion dollar organization as CFO. (PRA)

- Increased cash flow by more than $1.2M annually and produced net bottom line of 35% through various operational efficiencies.(GRC,CBIZ)

- Completed the 3-month-early implementation of new cost-efficient systems and operational processes that facilitated a 25% reduction in enterprise-wide operating costs. (PRA)

- Delivery Executive for large scale strategic advisory, CFO, business process improvement and information technology engagements.(Integrate,GRC,CBIZ, E&Y)

- Directed firm wide PMO, (Project Management Organization) which enabled efficient interface and coordination with client executive management and consulting teams to ensure all projects were delivered on time and on budget (Integrate,GRC,CBIZ)

Sales Growth

- Increased sales volume from $2.5 million to $23 million within 5 years by developing/executing channel marketing strategy.(GRC, LLC)

- Achieved 20% growth per year through firm-wide strategic action plans.(Integrate,GRC,CBIZ,E&Y)

- Built and drove sales revenue to $85 million from $25 million base following an integrated business development and acquisitions strategy for multiple business services and product lines.(CBIZ)

- Expanded service capability and offerings from compliance based solutions to strategic advisory services thereby doubling service revenue for (GRC,CBIZ)

- Penetrated multiple national and international markets and opened new global business channels as a member of PKF International by developing international service delivery capability. (GRC)

Sales Management

- Built strong management teams with cross-functional disciplines to win and deliver contracted services.(Integrate,GRC, CBIZ, E&Y)

- Developed fully integrated sales functions and processes which incorporated web content, business offerings, scripts and value propositions, relationship selling, expansion of existing services to clients, new business creation through the use of multiple pursuit teams.(Integrate, GRC, CBIZ)

- Directed and managed sales and business development professionals through incentive based compensation arrangements producing effective targeted meetings with C-Level Executives, strong presentations and winning client centered solutions achieving annual sales growth of 20%(Integrate,GRC,CBIZ)

- Built regional and national sales pursuit teams between Client Service Directors and Business Development and Sales professionals achieving annual sales goals.(Integrate,GRC,CBIZ)

High Profile Clients Gained / Industries Penetrated

- Notable Clients: Kulicke & Soffa, The New York Times, Keystone National Bank and Trust, American Financial Realty Trust, Heartland Payment Systems, Toll Brothers, Amerisource Bergen, Sealed Air, GlaxoSmithKline, Jefferson Health System, Wolters Kluwer, The Princeton Review, Bear Stearns, Lincoln Financial, Unilever Corporation, Sterling Bank, Wells Fargo, ICI Global, QVC, Penn National Gaming, Altria, GE, Royal Bank, AIG, Keating Development, GMAC, Brandywine REIT, GSA, Trump Organization, Harrahs Marina, FMC Corporation, EI DuPont, Lexington Corporate Properties Trust, Sharp, Prudential Financial, Corporate Office Properties Trust, Wilmington Trust.

- Multiple industry experience includes Financial Services, Manufacturing, Distribution, Real Estate, Healthcare, Pharmaceuticals, Retail, Energy, Oil & Gas, Chemicals, Construction, Leisure, Entertainment, & Gaming and Not-For-Profits.

Selected Client Engagement Summaries

Financial Advisory, Strategy, Planning & Budgeting, Forensic and Compliance

- Developed the complete structural blueprint and market repositioning for financial services, manufacturing, leisure and entertainment and technology clients. $500k – $1.5 million

- Conducted organizational redesign, market and financial feasibility engagements for high profile clients within real estate, gaming and leisure and entertainment industries. $300k – $1 million

- Directed an engagement for Prudential Financial to install financial planning, budgeting and forecasting procedures which in turn increased profitability 20%-30% assisting the client to expand operations into new markets and products. $1.5 million

- Directed and managed a financial and operational due diligence engagement for a $100 million capital purchase transaction of a complete real estate portfolio for Brandywine Real Estate Investment Trust generating a 20% reduction in the purchase price. $2 million

- Lead a forensic financial and operational improvement audit that embarked the Trump Organization to recoup nearly half or $5 million of the $10 million in excess charges in pre-opening costs from corporate shared services operations with Harrahs Marina. $1 million

- Testified as an expert witness and dismissed a $6 million class action law suit for a Major Philadelphia Financial Institution concerning alleged overcharges to bank depositors. $1.2 million

- Directed and managed consultants in the financial and market feasibility of a landmark $100 million mixed use luxury hotel property development on the prestigious Rittenhouse Square in Philadelphia, PA, generating the developer a positive 25% ROI. $650k

- Directed numerous engagements involving forensic and reconstructive accounting efforts, the preparation and review of financial forecasts and projections, operational business strategies, development of business plans and complex financial models for financial services, insurance, manufacturing, real estate, health care and leisure and entertainment industry clients. $250k – $1 million

- Directed and managed the comprehensive planning and execution of financial audit engagements for real estate, construction, entertainment and gaming and financial services industry clients $200K – $5 million

CFO Assist, Financial Management, Process Transformation/Working Capital Optimization

- In CFO capacity, negotiated with lenders to allow for the restructure, extension and acquisition of a $2.5B debt portfolio which provided the company with an additional $100M in working capital in challenging times to sustain operations. $750k

- In CFO capacity, successfully leased over 7.5 million square feet of commercial office and retail space during adverse industry conditions to increase and maximize working capital requirements. $500k

- Directed engagement team efforts in a business process optimization and costing standards development project for EI DuPont yielding annual corporate savings of $75 million for the financial transaction processing and budget, planning and forecasting divisions covering an annual budget of $750 million. $3 million

- Directed an engagement for Walters Kluwer to perform a financial management oversight project involving numerous account reconciliations for financial statement account balances and a financial process and controls transformation effort. The end result was an overall working capital savings of $10 million annually, a complete reconciliation of outstanding account balances for year end purposes and the development of new policies and procedures. $1.5 million

- Directed an engagement for AIG for the complete reconciliation of reinsurance account balances with actual reinsurance treaty documents and business process improvement of reinsurance processes. The engagement resulted in saving the client $20 million in potential reinsurance payouts. $750k

- Directed an engagement involving the reconciliation of all outstanding financial account balances and financial transformation of all underlying processes and controls for an international UK group involved in the manufacture and distribution of printing machinery. The engagement resulted in the implementation of more efficient and effective account reconciliation processes, policies and procedures and identified over $25 million in annual savings opportunities on a $150 million SG&A budget. $1 million

- Directed engagement efforts in the development of more efficient and effective financial control and reporting policies and procedures for AMBAC Financial and Integra Life Sciences resulting in a more efficient financial close process reducing the close process from 10 days to 2.5 days. $500k

- Directed and managed a CFO assist engagement for Henkel Corporation providing more efficient and effective corporate financial planning, budgeting and internal control management reporting functions for an extended 14 month period. $800k

Enterprise Cost Reduction, Shared Services, Internal Audit, ERM and Controls Transformation

- Reduced SG&A expenses by at least 25%-30% for clients by delivering new/improved processes and related enabling technologies within operations focusing on sustainable repeatable business processes. notable clients Unilever, Lincoln Financial, New York Times, Amerisource Bergen Sizes range from $750k – $4.5 million

- Facilitated 25-30% reductions in overhead manufacturing costs and financial business process improvements through the elimination of redundant processes, delivering enabling technology, reduction of gaps and overlapping functions during a 7-year period for a variety of large Fortune 500 client engagements. Sizes range from $500k – $5 million

- Directed firm wide PMO, Project Management Organizations which enabled efficient interface and coordination with client executive management and consulting teams to ensure all projects were delivered on time and on budget. to ensure cost minimization to clients.

- Directed engagement team efforts in the review, analysis and restructure of the corporate shared services division and implementation of key performance indicators for Glaxo-Smithkline covering a $200 million budget which yielded annual cost savings of more than $25 million. $1 million

- Directed numerous engagement efforts in multiple industries in enterprise wide cost reductions for business process and IT controls transformation projects including ICI Global, streamlining corporate operating and reporting controls spend by more than $8 million in year 1 and $7.5 million thereafter. $8.5 million

- Directed the development, review and analysis of shared services operations for L'Oreal corporate and divisional operations. Service level agreements and a complete set of key performance indicators and standards were developed for financial reporting, planning, budgeting and processing, with the overall project yielding a 35% reduction in corporate SG&A costs. $2 million

- Directed engagement efforts in providing internal audit co-sourcing services in the planning and execution of various financial, operational and IT audits for Jefferson Health Systems, Keystone National Bank and other real estate, construction and financial services clients. The operational and performance improvement reviews for business processes and IT resulted in enterprise cost reductions of more than 20% of the original budget. $500k – $1 million

- Directed an engagement to optimize financial reporting controls testing through the use of monitoring controls for Unilever Corporation. The project yielded a 50% reduction in controls testing through the use of the new method. $1 million

- Directed engagement efforts in an enterprise risk management assessment and process installation for Sealed Air, a 3B manufacturing company. The engagement incorporated the definition of business drivers, risks and vulnerabilities, analysis of the corporate risk spend and baseline to industry as well as development of the overall risk strategy and impact on corporate strategy. The project culminated in the identification of more than 50 quick hit opportunities which had significant positive impact on corporate strategy and operations. $800k

Technology Strategy and Implementation, Including Related Business Process Transformation

- Instrumental in assisting GE Financial Assurance in a financial process and technology transformation during an interstate relocation of its reinsurance division to maintain uninterrupted financial operations which yielded cost savings of 35% Engagement activities focused on planning, budgeting, analysis, controllership and all related accounting and financial information reporting functions and processes. $2 million

- Managed more than 50 consultants in developing new technology strategy, business processes and controls including senior and middle management reporting requirements for Martin Marietta, Commonwealth Federal Savings and Trump Organization $2.5 million

- Directed engagement team efforts to ensure business processes, controls and technology were optimized within a JD Edwards systems installation for American Financial Realty Trust, a major Pennsylvania REIT. The project streamlined the existing business process and IT environments by reducing gaps, eliminating redundancies creating efficient and effective workflow and internal controls between functions, reducing corporate overhead expenses by more than 25%. $5 million.

- Directed a complete financial transformation and installation of new financial and business processes and related enabling technology systems for the prestigious Valley Forge Military Academy reducing overall SG&A costs by more than 25% annually. $2 million

- Directed engagement team of 35 consultants in the definition of new financial and operational business processes and reporting requirements for all major services sectors of the General Services Administration in Washington DC. $5 million

- Directed 28 successive engagements relating to information technology design, selection, evaluation and implementations for AARP relating to membership, operational and financial processing environments 500k – $8.5 million

- Directed engagement efforts in a business process improvement effort for One Beacon Insurance. The project yielded a 30% reduction in costs through implementation of more effective business processes and internal control systems $750k

Print this Page

Print this Page

Totally capable of managing both top and bottom line drivers with ROI always in mind.

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Proficiencies

Print this Page

Print this Page

Developed and grew start-up B2B services firm to fastest growing of 'Bowmans Top 100' in 2006.

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Career Experience

Integrate Consulting

Direct, with full P&L, all sales and service delivery operations for this national consulting and advisory firm targeting and servicing Fortune 500 and high-end Mid Market clients across multiple industries.

(2011-present)

- President / Senior Partner

GR Consulting, LLC

Developed and directed, with full P&L, all operations for this $32M, national and international consulting and business advisory firm targeting & servicing Fortune 500 and high-end Mid Market clients across multiple industries.

(2001-2010)

- President and Managing Partner

CBIZ

Led business development group and engagements for this $85M, national accounting, tax and business advisory firm providing consulting to CFO’s of Fortune 500 and CEO’s of emerging and closely held businesses.

(1995-2000)

- Business Development/Practice Senior Director

PRA Development & Management Corp.

Supervised 50+ employees and controlled a $250M budget for this national real estate development, construction and property management company.

(1990-1995)

Ernst & Young

Served, for this 'Big 4' firm, Fortune 500 companies within the manufacturing, health care, real estate, gaming, government, and financial services sectors. Supervised up to 50 professionals depending on engagement.

(1982-1990)

Print this Page

Print this Page

Obtained 'Vision Award' for the top performing national Director (selling 200% over goals).

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Education

Widener University

- M.B.A., Corporate Finance, 1981, Deans List

University Of Delaware

- B.A., Accounting and Arts & Sciences, 1979, Deans List

Licenses/Memberships

- C.P.A., Active license in MD, DE, and PA

- Member of AICPA

Awards

- Obtained 'Vision Award' for the top performing national Director (selling 200% over goals).(CBIZ)

Print this Page

Print this Page

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Contact Vince

Vincent DiMauro, CPA, MBA welcomes the opportunity to speak with you about your business needs and his background/qualifications. Please complete the information below and click 'Send to Vince' to arrange a call or interview at a convenient time.

Totally capable of managing both top and bottom line drivers with ROI always in mind.

Vincent DiMauro, CPA, MBA

Business Development/Delivery Executive

Performance Results

Print this Page

Print this Page

![cssbody=[dvbdy1] cssheader=[dvhdr1] fade=[on] fadespeed=[0.10] header=[My Results] body=[View My Results Graphs] My Results](images/mygraph.gif)

![cssbody=[dvbdy1] cssheader=[dvhdr1] fade=[on] fadespeed=[0.10] header=[My Proficiencies] body=[View My Proficiencies Chart] My Proficiencies](images/myprof.gif)

![cssbody=[dvbdy1] cssheader=[dvhdr1] fade=[on] fadespeed=[0.10] header=[My LinkedIn] body=[View My LinkedIn Profile] My LinkedIn](images/mylinkedin.gif)